Data from each location can be entered into the online calculator and it will generate a single Schedule INV. Use the following calculator to help determine your estimated tax liability. DOR's online inventory tax credit calculator has the capability to track numerous separate locations. Taxpayers with multiple locations that are subject to ad valorem tax on inventory can file a single Schedule INV.

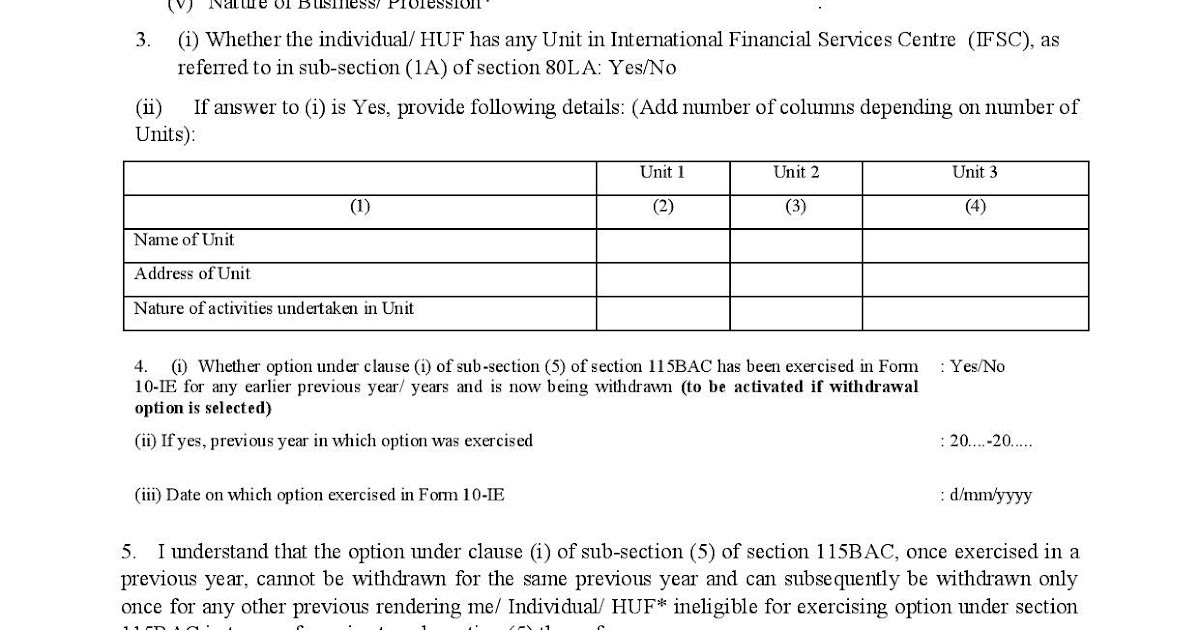

Finally, the taxpayer can call the PVA of the county where the property is located to obtain the district number.The websites of most county property valuation administrators (PVAs) also have address lookup functions that can provide district numbers.DOR's dedicated inventory tax credit phone line at (502) 564-1555 can also provide the information if the taxpayer can provide the FEIN or the SSN of the entity or person paying the tax. Many property tax bills include the county and district number where the property being assessed is located. The county and the district number where the taxable property is located Most Kentucky property tax bills do not separately itemize the tax on inventory from taxes on other categories of tangible property therefore, the DOR Inventory Tax Credit Calculator is the best tool to correctly compute the tax credit. It is based ONLY upon the taxes regarding inventory. The inventory tax credit is NOT based upon all the tangible personal property tax you paid timely to a Kentucky taxing jurisdiction.Lines 31-36 are the relevant lines on this form, as this is where the inventory values are reported.Member FINRA and SIPC. Copies of all tangible personal property tax returns (Form 62A500) Investment products are not insured by the FDIC, NCUA or any federal agency, are not deposits or obligations of, or guaranteed by any financial institution, and involve investment risks including possible loss of principal and fluctuation in value.Īmeriprise Financial Services, LLC. See how income, withholdings, deductions, and credits impact your tax refund or balance due.

#Tax return calculator free

Consumers should consult with their tax advisor or attorney regarding their specific situation. Estimate your tax refund using TaxActs free tax calculator. and its affiliates do not offer tax or legal advice. Please seek the advice of a financial advisor regarding your particular financial situation.Īmeriprise Financial, Inc. The information is not intended to be used as the sole basis for investment decisions, nor should it be construed as a recommendation or advice designed to meet the particular needs of an individual investor. It is given as a general source of information and is not a solicitation to buy or sell any securities, accounts or strategies mentioned.

This information is provided third parties and have been obtained from sources believed to be reliable, but accuracy and completeness cannot be guaranteed by Ameriprise Financial.

0 kommentar(er)

0 kommentar(er)